The Kelly Criterion is one of the most important aspects of gambling from roulette to sports betting to stock market investing. Once you understand the rules of roulette and know everything you need to know about the basics, then it’s time to explore some other aspects of roulette, particularly bet sizing and the Kelly Criterion.

Over the long run, the house that offers an American Wheel (with a double zero) versus the European or French wheel (that only has a single zero) has a better edge over you. If you are going to play roulette, then you need to make wagers with the best value and edge possible, while trying to maximize your profit and minimize any losses. A formula like the Kelly Criterion will help you maximize profits by wagering the optimal amount every time.

IMAGE SOURCE: Ask.com

WHAT IS THE KELLY CRITERION?

The Kelly Criterion, in theory, attempts to maximize the growth of your bankroll and this can be applied to any game no matter how much variance said game has.

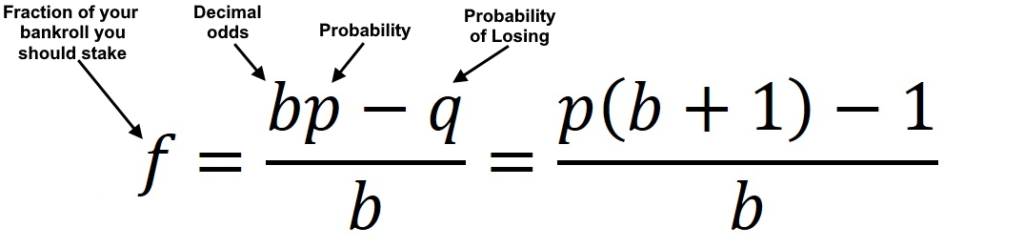

Kelly’s formula is:

f = bp – (1-p) / b

f = fraction of current bankroll to bet

b = net odds

p = probability of winning

IS KELLY A REAL PERSON?

Yes, the Kelly Criterion is based on a real-life person, who is revered by gamblers and stock-market investors alike. John Larry Kelly Jr. grew up in Texas and was a decorated fighter pilot during World War II. After the war, Kelly studied math and physics at the University of Texas. Kelly excelled and he earned a PhD in Physics. After graduation, Kelly was a highly sought-after prospective employee and courted by different companies including multiple job offers from the United States Government. Kelly took a position at Bell Labs, where he developed the first-ever talking computer. In his spare time, Kelly and his wife were avid blackjack players. They frequently visited Las Vegas along with a colleague from M.I.T. named Ed O. Thorp. Kelly tried to figure out the exact mathematics behind optimal black jack strategy and eventually came up with the Kelly Criterion.

Ed O. Thorp also did valuable research into probability while at M.I.T. and published a book, “How to Beat the Dealer.” Thorp was a strong advocate of the Kelly Criterion. He explained: “Those individuals or institutions who are long term compounders should consider the possibility of using the Kelly Criterion to asymptotically maximize the expected compound growth rate of their wealth.”

Eventually Wall Street bankers learned about Kelly’s research and many of them applied the Kelly Criterion to maximize profits with their own investment strategies.

WHY USE KELLY FOR ROULETTE?

Roulette is one of the best games to apply the Kelly Criterion, but only if you are going to do a particular type of betting. In roulette, punters have a wide variety of betting types to choose from inlcuing inside/outside bets, specific numbers, odds/evens and groups of numbers. However, if you want to use the Kelly Criterion, it’s best to limit your type of roulette wager to a red/black bet.

If you’re an adventurous gambler or reckless punter who wants to risk their bankroll on every bet, then you are not going to last very long. Happiness and bliss lies somewhere in the middle. You don’t want to be on the brink of going broke with every wager. At the same time, you don’t want to be at the opposite end of the spectrum with ultra-conservative wagers. You won’t go busto anytime soon, but if you’re not going to risk anything then you are never going to amass any wealth.

AVOID UNDERBETTING

You want to avoid making the most common mistakes in roulette. Bet-sizing is one of those egregious mistakes you don’t realize you’re making until it’s too late. Overbetting is a bankroll killer, but underbetting is probably worse. Most underbetting is committed when you adhere to flat-betting, or wagering the same amount every time. Flat-betting might be simple because you stick to a set amount, but you are missing out on opportunities to maximize your profits by not wagering more during instances when you had a greater edge.

It’s important to be a cautious gambler before you make any wager, but over-cautiousness can cost you in the long run. Adhering to the Kelly Criterion helps you assuage any fears because you’d be betting the mathematically correct amount so you are not under-betting.

IMAGE SOURCE: picsvegaspics.blogspot.com

The optimal strategy lies between the extremes of betting too much and underbetting too little. Kelly stipulated that the fraction of your bankroll to be staked equals the size of your edge. For example

if the chance of a win is 51%, and the price available is even, then you should bet your edge of 2% (51% minus 49%), 49% being the probability of losing. If you come across a bigger edge or a chance to win of 53%, then your stake should be 6% (53% minus 47%).

PARTIAL KELLY

According to Ed Thorp, “Investors with less tolerance for intermediate term risk may prefer to use a lesser fraction. Long term compounders ought to avoid using a greater fraction (“overbetting”). Therefore, to the extent that future probabilities are uncertain, long term compounders should further limit their investment fraction enough to prevent a significant risk of overbetting.”

Many pro gamblers, especially sports bettors, adhere to betting partial Kelly wagers, like 1/2 or 1/4. Those are known as the Half-Kelly and the Quarter-Kelly. This could be applied to various games like roulette, black jack, and sports betting. For example, if you want to minimize your overall exposure with an NBA bet, you can wager a Half-Kelly on the Golden State Warriors beating the Los Angeles Lakers.

IMAGE SOURCE: lonebesttravel.wordpress.com

CONCLUSION

The Kelly Criterion is a valuable tool to help you make the right-sized bet. It can be applied to different aspects of gambling and investing, especially in roulette. So long as you pay close attention to your bankroll and use the Kelly Criterion, you can have peace of mind knowing the Kelly will be the proper betting amount that will maximize your profit while still having a comfortable level of risk.

Just what I needed! Thanks for the article Mate!